Role & Scope

• Led UX for customer-facing and agent-facing mobile products in a highly regulated financial-services environment.

• Partnered with Legal, Compliance, and Risk to design experiences that were both compliant and empathetic.

• Worked end-to-end—from discovery interviews and journey mapping through wireframes, hi-fi design, and design QA.

Customer Experience

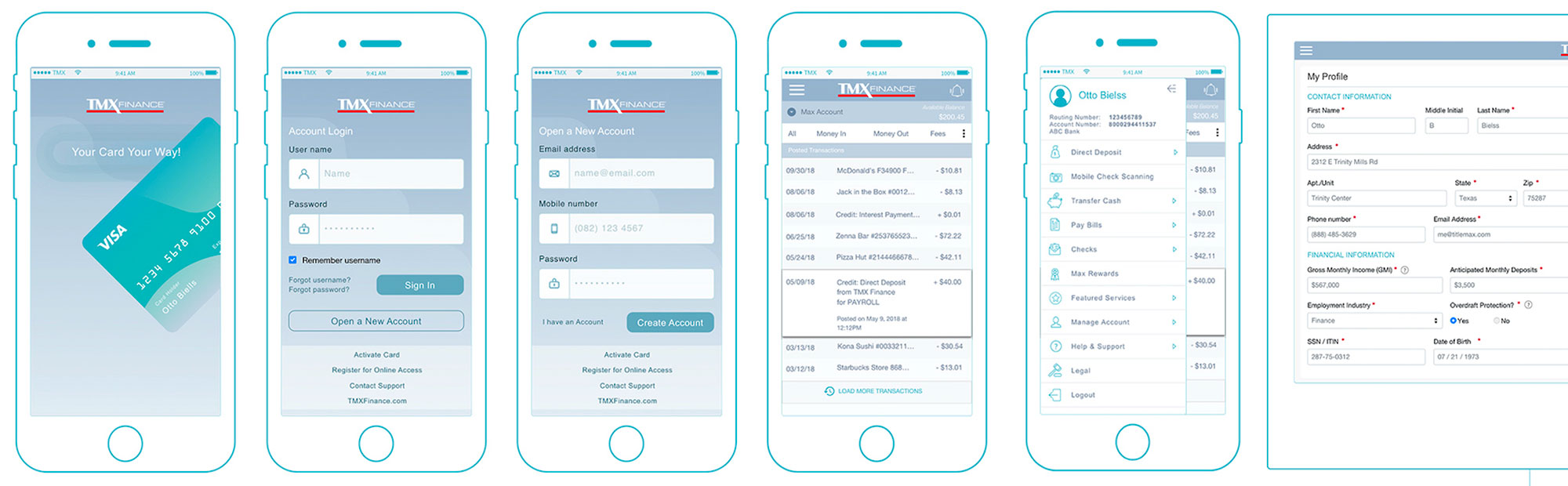

MOBILE CUSTOMER EXPERIENCE

• Re-designed key flows such as onboarding, account access, payments, and support to reduce friction and drop-off.

• Clarified complex financial concepts (fees, schedules, consequences of missed payments) with plain language and visual aids.

• Used progressive disclosure to keep screens focused while still allowing power users to dig into details when needed.

• Enabled self-service where appropriate while preserving clear paths to live assistance for sensitive scenarios.

Operational Tools

AGENT & OPERATIONS TOOLS

• Designed tablet and desktop tools used by in-store and call-center agents to support customers quickly and consistently.

• Reduced swivel-chair behavior by consolidating information and actions into fewer screens with clearer status indicators.

• Embedded guardrails and just-in-time guidance that helped agents stay within policy while still exercising judgment.

Compliance & Trust

COMPLIANCE & TRUST

• Collaborated closely with Compliance and Legal to visualize disclosures, consent, and eligibility criteria in ways customers could truly understand.

• Used UX research to uncover where misunderstandings or anxiety occurred, then re-designed touchpoints accordingly.

• Helped shift internal conversations from “what are we allowed to say?” to “what do customers actually need to understand to make a good decision?”

Digital Onboarding

Note: I’m actively updating this section with a full case study for this position, including before/after states, outcomes, and team context.